If you’re turning 65 or dealing with Medicare, you’re probably feeling overwhelmed. One wrong move can cost you thousands of dollars for the rest of your life. The unfortunate truth is that every year thousands of seniors make big mistakes during their Medicare enrollment that can result in expensive penalties, and some of these errors can stick with you forever.

With 68 million people enrolled in Medicare as of September 2024 and more than half (54%) of eligible Medicare beneficiaries enrolled in Medicare Advantage plans in 2025, the stakes have never been higher.

Don’t let Medicare catch you off guard – your financial future depends on getting it right the first time!!!

27. Ignoring Your Medicare Summary Notice (MSN) Bills

Most people toss their MSN in the trash without a second thought, but this is a huge mistake. Billing errors are surprisingly common, including incorrect billing codes, duplicate charges, and billing for unrendered services. You might be paying for services you never received or getting charged for procedures that should have been covered.

Take ten minutes each month to go through your MSN line by line – it’s worth the peace of mind. The Medicare Summary Notice (MSN) and Explanation of Benefits (EOB) outline the details of services billed to Medicare, along with what Medicare covered and what you may owe.

Key MSN Review Steps:

- Review MSNs within 30 days of receiving them

- Compare charges against your actual medical visits

- Report any discrepancies immediately to Medicare

- Keep detailed records of all medical services received

| Common Billing Error | Frequency | Average Cost Impact |

|---|---|---|

| Duplicate Charges | 15-20% of claims | $200-$800 |

| Incorrect Procedure Codes | 10-15% of claims | $150-$1,200 |

| Services Not Rendered | 5-8% of claims | $100-$500 |

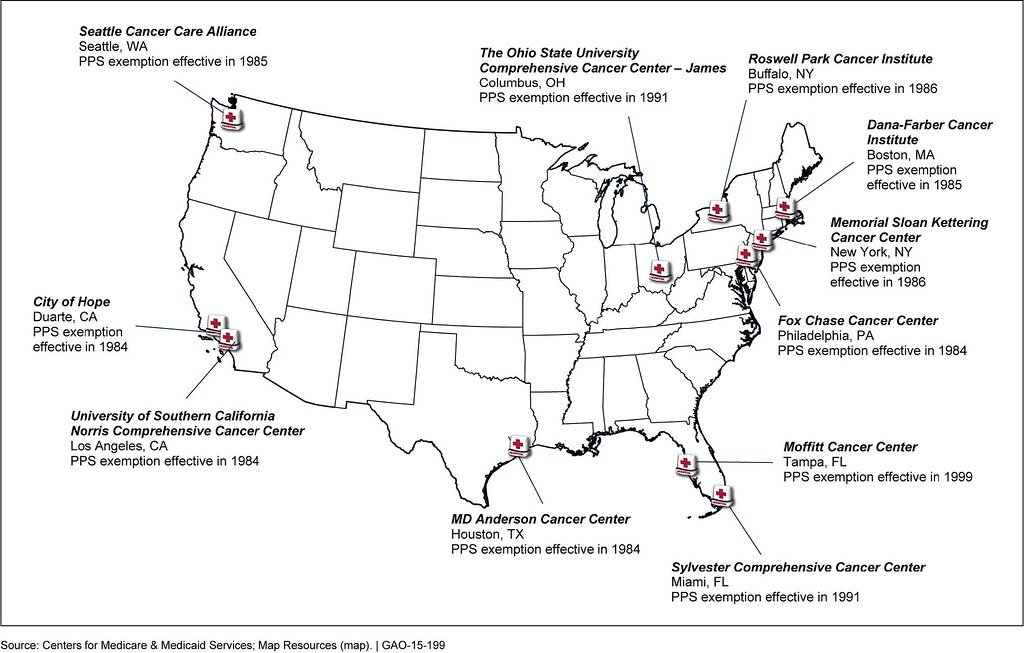

26. Not Understanding Network Restrictions in Medicare Advantage

This mistake hits people hard when they need specialized care. A 2017 analysis found that Medicare Advantage networks included fewer than half (46%) of all Medicare physicians in a given county, on average. Even worse, nearly half of MA plan networks include no psychiatrists.

Before you choose any Medicare Advantage plan, check if your current doctors are in the network. Don’t just assume they’ll be covered because the plan sounds good on paper. UnitedHealthcare has implemented substantial network adjustments for 2025, continuing the trend of health plans narrowing their provider networks to control costs.

Network Restriction Reality:

- Only 46% of Medicare physicians are typically included in MA networks

- Nearly 50% of MA networks have no psychiatrists

- Some networks are restricted to just one county

- Out-of-network costs can be extremely high

- 32 health systems have dropped various Medicare Advantage plans in 2024-2025

25. Failing to Report Changes in Income for Extra Help Programs

Many seniors qualify for Medicare’s Extra Help program but don’t realize they need to report income changes throughout the year. If your income drops due to retirement, job loss, or other circumstances, you might suddenly qualify for significant savings on your prescription drug costs.

The Extra Help program can save you thousands annually on Part D costs, but only if you keep Medicare updated on your financial situation. Don’t wait until the end of the year to report changes – they can be retroactive, meaning you could get money back.

Extra Help Income Thresholds (2025):

| Household Size | Monthly Income Limit | Resource Limit |

|---|---|---|

| Individual | $2,178 | $16,660 |

| Married Couple | $2,932 | $33,240 |

24. Choosing Medicare Advantage Plans Based Only on Extra Benefits

That gym membership or dental coverage might look appealing, but it’s meaningless if you can’t see your doctor or get the care you need. Research shows that people aren’t even using the extra benefits they’re paying for – only 54.2% of those on Medicare Advantage plans were aware of having dental coverage, and only 54.3% were aware of having vision coverage.

The share of plans offering certain benefits has declined, such as over-the-counter benefits (85% in 2024 vs. 72% in 2025), remote access technologies (74% in 2024 vs. 53% in 2025), meal benefits (72% in 2024 vs. 65% in 2025) and transportation (36% in 2024 vs. 29% in 2025).

Benefits Awareness Statistics:

- Only 54.2% know they have dental coverage

- Only 54.3% know they have vision coverage

- Many pay for benefits they never use

- Extra benefits don’t matter if basic care is restricted

23. Not Taking Advantage of the Free Look Period

You get a 30-day trial period with your new Medigap policy, but many people don’t know this exists. You have the right to review a new Medigap policy for the first 30 days. If you don’t like it, you can return it for a full refund, no questions asked.

This is your safety net if you realize you made the wrong choice. Use this time to test out the coverage, see how claims are processed, and make sure it meets your needs. Don’t cancel your first Medigap policy until you’ve decided to keep your second Medigap policy.

22. Missing the 63-Day Rule for Continuous Coverage

The magic number is 63 days. If you go 63 days or more without creditable drug coverage, you’ll face a Part D late enrollment penalty. This applies when switching from employer coverage to Medicare, changing plans, or any gap in coverage.

Keep careful records of your coverage dates, and never let there be a gap longer than 62 days. Even one extra day can trigger penalties that last forever.

Coverage Gap Consequences:

- 63+ days without coverage triggers penalties

- Penalties last for life in most cases

- Applies to all creditable coverage types

- Documentation is crucial for appeals

21. Not Understanding Creditable Coverage Rules

Creditable coverage isn’t just Medicare Part D – it includes employer plans, VA benefits, and other qualifying programs. Many people don’t realize their current coverage counts, so they sign up for Part D unnecessarily or worry about penalties when they’re actually protected.

Get a letter from your current insurance provider stating whether your coverage is creditable. Keep this letter forever – you’ll need it as proof if Medicare ever questions your enrollment decisions.

20. Assuming All Medicare Advantage Plans Are the Same

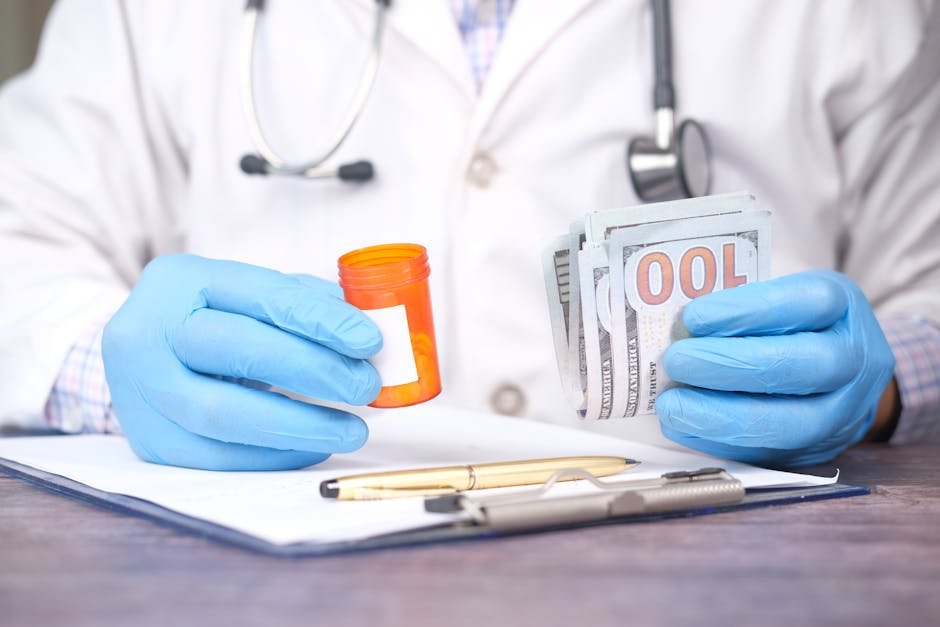

Medicare Advantage plans vary dramatically in coverage, networks, and costs. What works great in one area might be terrible in another. Congress’s Medicare Payment Advisory Commission (MedPAC) estimates that MA payments in 2024 were 22 percent above traditional Medicare – a difference that amounts to $83 billion in annual spending.

Each plan has different rules for referrals, prior authorizations, and coverage limitations. Just because your neighbor loves their plan doesn’t mean it’s right for you.

Plan Variation Factors:

- Network size and provider access

- Prior authorization requirements

- Prescription drug formularies

- Geographic coverage areas

- Annual benefit changes

19. Delaying Enrollment While Still Working Past 65

You won’t be automatically enrolled in Medicare at age 65 unless you receive Social Security benefits at least four months before your 65th birthday. Working past 65 creates complex enrollment scenarios that trip up many people.

Your employer plan size matters – companies with fewer than 20 employees mean Medicare becomes primary, while larger companies allow Medicare to be secondary. Get this wrong and you could face penalties or coverage gaps.

18. Not Shopping During Open Enrollment Every Year

Your Medicare plan changes every year, even if you do nothing. Networks shrink, formularies change, and costs shift. What was a great plan last year might be a disaster this year.

Set a reminder every October to review your options during the annual open enrollment period from October 15 to December 7.

Annual Changes to Monitor:

- Premium increases or decreases

- Formulary changes affecting your medications

- Network changes affecting your doctors

- Benefit modifications or reductions

17. Thinking You’re Automatically Enrolled at 65

This is one of the most dangerous assumptions people make. You won’t be automatically enrolled in Medicare at age 65 unless you receive Social Security benefits at least four months before your 65th birthday.

If you’re not collecting Social Security, you must actively sign up for Medicare. Miss this window and you’ll face lifelong penalties. The enrollment window starts three months before your 65th birthday and ends three months after.

16. Not Understanding Part D Penalty Calculations

The Part D late enrollment penalty is calculated by multiplying 1% times the “national base beneficiary premium” ($36.78 in 2025) times the number of full, uncovered months you were eligible to join Medicare drug coverage but didn’t.

Wait 12 months and you’ll pay 12% more forever – that’s about $4.41 extra per month for life based on 2025 rates. The Part D late enrollment penalty is added to your premium for as long as you have Medicare drug coverage, even if you switch plans.

Penalty Calculation Example:

| Delay Period | Penalty Percentage | Monthly Penalty (2025) | Annual Extra Cost |

|---|---|---|---|

| 6 months | 6% | $2.21 | $26.52 |

| 12 months | 12% | $4.41 | $52.92 |

| 24 months | 24% | $8.83 | $105.96 |

15. Choosing the Wrong Medigap Plan Letter

Medigap plans are standardized by letter (A, B, C, D, F, G, K, L, M, N), but each offers different coverage levels. Many people choose based on price alone without understanding what they’re giving up.

Plan F offers the most comprehensive coverage but isn’t available to new Medicare beneficiaries as of 2020. Plan G is now the most popular comprehensive option. Plan N offers lower premiums but requires copays for doctor visits and emergency rooms.

Popular Medigap Plans Comparison:

| Plan | Coverage Level | Key Features | Average Premium |

|---|---|---|---|

| Plan G | Comprehensive | Covers Part B excess charges | $140-180/month |

| Plan N | Good | Lower premium, requires copays | $110-140/month |

| Plan F | Most Comprehensive | Only for pre-2020 enrollees | $160-200/month |

14. Missing Your Medigap Open Enrollment Window

You only get one six-month window to buy Medigap without medical underwriting. It starts the first month you have Medicare Part B and you’re 65 or older. This protection doesn’t repeat every year, like Medicare’s Open Enrollment Period.

Miss this window and insurance companies can deny you coverage or charge you more based on your health. This protection is crucial if you develop health issues later.

13. Buying Medigap While Enrolled in Medicare Advantage

It’s illegal for someone to sell you a Medigap policy if you have a Medicare Advantage Plan. This seems obvious, but scam artists specifically target Medicare Advantage enrollees with illegal Medigap sales.

If someone tries to sell you both, run away immediately. You can only have one or the other, never both. Medicare Advantage plans are required to have out-of-pocket limits that serve a similar function to Medigap.

12. Not Researching Prescription Drug Coverage Adequacy

No Medicare drug plan may have a deductible more than $590 in 2025, and some plans have no deductible. Not all Part D plans cover all drugs, and your medications might not be on the formulary of the cheapest plan.

After you reach your full deductible, you’ll pay 25% of the cost as coinsurance for your generic and brand-name drugs until your out-of-pocket spending on covered Part D drugs reaches $2,000 in 2025.

2025 Part D Coverage Stages:

- Maximum deductible: $590

- Initial coverage: 25% coinsurance after deductible

- Catastrophic coverage starts at $2,000 out-of-pocket

- You won’t have to pay out-of-pocket for covered Part D drugs for the rest of the calendar year after reaching catastrophic coverage

11. Assuming Medicare Advantage is Always Cheaper

Medicare Advantage plans often advertise $0 premiums, but that doesn’t mean they’re cheaper overall. When you add up premiums, deductibles, copays, and coinsurance, Medicare Advantage can actually cost more, especially if you need significant medical care.

Two-thirds of all Medicare Advantage plans with Part D prescription drug coverage (MA-PDs) (67%) will charge no premium (other than the Part B premium) in 2025, similar to 2024 (66%).

True Cost Comparison Factors:

- Monthly premiums for all parts

- Annual deductibles and out-of-pocket maximums

- Provider access and network restrictions

- Prior authorization requirements

- Prescription drug coverage

10. Getting Trapped in Medicare Advantage Plans

Once you’re in Medicare Advantage and develop health problems, switching back to Original Medicare becomes very difficult. Since you enrolled in a Medicare Advantage plan instead of traditional Medicare and developed health conditions, you could be denied Medigap or charged much higher rates.

This is the Medicare Advantage trap – healthy people can switch easily, but sick people who actually need the coverage flexibility get stuck. Plan very carefully before choosing Medicare Advantage, especially if you have any health concerns.

9. Not Understanding Medicare Part B Premium Penalties

Part B penalties are 10% of the premium for each 12-month period you were eligible but didn’t enroll. Wait two years and you’ll pay 20% more forever.

If you waited 2 full years (24 months) to sign up for Part B, you’ll have to pay a 20% late enrollment penalty plus the standard Part B monthly premium ($185 in 2025). $185 (2025 Part B standard premium) + $37 (20% penalty) = $222 will be your Part B monthly premium for 2025.

Part B Penalty Impact:

| Delay Period | Penalty Rate | 2025 Monthly Cost | Lifetime Extra Cost |

|---|---|---|---|

| 12 months | 10% | $203.50 | $222+ per year |

| 24 months | 20% | $222.00 | $444+ per year |

| 36 months | 30% | $240.50 | $666+ per year |

8. Failing to Understand Medicare Advantage Prior Authorization

Medicare Advantage plans can deny treatments that Original Medicare would cover automatically. Prior authorization means you need plan approval before getting certain treatments, tests, or medications. This can delay care when time is critical, and plans sometimes deny procedures your doctor believes you need.

Nearly all Medicare Advantage enrollees are required to obtain prior approval, or authorization, for coverage of some treatments or services – something generally not required in traditional Medicare.

Prior Authorization Impacts:

- Delays in receiving necessary care

- Additional paperwork and phone calls

- Potential denial of doctor-recommended treatments

- Appeals processes can take weeks or months

7. Not Planning for Long-Term Care Needs

Medicare doesn’t cover long-term care, and this comes as a shock to many retirees. Recent estimates show the average couple retiring today can expect to spend close to $395,000 on health care in retirement.

Nursing homes, assisted living, and home health aides are mostly out-of-pocket expenses. A private room in a nursing home averages over $100,000 per year nationally. Plan for these costs separately from Medicare – consider long-term care insurance or self-funding strategies.

6. Ignoring State-Specific Medicare Rules

Federal Medicare rules are just the baseline – many states offer additional protections and opportunities. There are 14 states (as of 2024) that offer an annual window during which existing Medigap enrollees can select from at least some other plans without medical underwriting.

Some states have birthday rules, anniversary rules, or other special enrollment periods that give you more flexibility than federal law requires.

State-Specific Benefits May Include:

- Annual Medigap switching opportunities

- Extended enrollment periods

- Guaranteed issue rights beyond federal minimums

- Under-65 disability protections

- Premium rate regulations

5. Making Healthcare Decisions Based on Marketing Materials

Insurance company marketing focuses on benefits and savings, not limitations and restrictions. Always read the full plan documents, not just the glossy brochures. Look specifically for the Summary of Benefits, Evidence of Coverage, and formulary.

The American Medical Association reports that provider directory errors are common across all insurers, with accuracy rates sometimes falling below 50%.

Marketing vs. Reality Red Flags:

- Emphasis on $0 premiums without mentioning other costs

- Highlighting extras while minimizing network restrictions

- Generic statements about coverage without specific details

- Pressure to “act now” without time to research

4. Not Understanding Medicare Supplement Pricing Methods

Medigap policies use three different pricing methods: community-rated, issue-age-rated, and attained-age-rated. Many people don’t understand these differences and choose poorly.

Community-rated means everyone pays the same price regardless of age. Issue-age-rated locks in your price based on your age when you first buy. Attained-age-rated increases as you get older. The same Plan G can have dramatically different long-term costs depending on the pricing method.

Medigap Pricing Methods:

| Pricing Method | How It Works | Long-term Cost Impact |

|---|---|---|

| Community-rated | Same price for all ages | Most predictable |

| Issue-age-rated | Price locked at enrollment age | Moderate increases over time |

| Attained-age-rated | Price increases with age | Highest long-term costs |

3. Dropping Medigap to Try Medicare Advantage

This is one of the most regrettable Medicare mistakes people make. If you drop your Medigap policy, you might not be able to get it back later. You might think you’re saving money by switching to Medicare Advantage, but if the MA plan doesn’t work out, getting Medigap back requires medical underwriting.

If you’ve developed health problems, you could be denied entirely or charged much higher rates.

2. Not Asking for Professional Help

Medicare is incredibly complex, yet most people try to navigate it alone. SHIPs offer free, 100% unbiased insurance counseling and assistance to Medicare-eligible older adults.

Free help is available through SHIP counselors, Medicare.gov, and the Medicare helpline at 1-800-MEDICARE. These resources are unbiased and won’t try to sell you anything.

Free Medicare Help Resources:

- State Health Insurance Assistance Programs (SHIP)

- Medicare.gov plan comparison tools

- 1-800-MEDICARE helpline

- Local senior centers and libraries

- Medicare Rights Center

1. Missing Your Initial Enrollment Period Entirely

This is the costliest Medicare mistake of all. Missing your Initial Enrollment Period triggers lifetime penalties for both Part B and Part D coverage. One study estimates that about 20% of people paying the Part B LEP did not know about these penalties at the time they reached age 65.

Your Initial Enrollment Period starts three months before your 65th birthday and ends three months after. If you wait too long, you could pay penalties for life. There’s also a coverage gap – you’ll have to wait until the next General Enrollment Period to sign up, leaving you without coverage.

Critical IEP Facts:

- Starts 3 months before your 65th birthday

- Ends 3 months after your 65th birthday month

- Missing it triggers lifetime penalties

- Coverage doesn’t start until July if you miss IEP

- No exceptions unless you qualify for Special Enrollment Period

Demographics of Late Enrollment Penalty Impact:

In 2021, a higher proportion of older Medicare enrollees paid Part B LEPs compared with younger enrollees (3% of those 95 and older, 2% of enrollees aged 85 to 94, and less than 1% of 65- to 74-year-olds). The share of Part LEP-payers was higher among American Indian/Alaska Native (2.5%), Hispanic/Latino (2.1%), Asian/Pacific Islander (1.8%) and Black (1.6%) enrollees than among White enrollees (1%).

The Medicare system can seem designed to trap the unwary, but knowledge is your best defense. Every mistake on this list is completely preventable if you understand the rules and plan ahead. Don’t let Medicare catch you off guard – your financial future depends on getting it right the first time.

Did you recognize any of these mistakes in your own Medicare journey?